Seasoned vs. New Tradelines: What’s the Difference?

Understand the credit impact of seasoned tradelines compared to newer accounts and how to choose what’s right for you.

Looking to purchase verified AU tradelines? View our Buy Tradelines page for secure inventory and escrow-backed transactions. Discover how Tradeline Score compares to others. Visit our homepage to learn more.

Watch: Seasoned vs New Tradelines – Which Is Better for Brokers?

If you’re comparing seasoned vs new tradelines, this quick video helps clarify the difference and why it matters for brokers. Learn how account age affects tradeline value, posting reliability, and resale potential. At Tradeline Score, we help brokers make smarter purchasing decisions based on buyer goals and platform compliance—so you can deliver results with confidence and transparency.

When comparing seasoned vs new tradelines, it’s important to consider your credit goals and the structure of your report. In most cases, seasoned tradelines—those with two years or more of age—can add greater stability to your profile and may help with factors like age of accounts or credit mix. New tradelines, while generally more affordable, typically offer limited impact unless layered strategically. Our experience shows that the right choice often depends on how your existing accounts are reporting and what you’re trying to achieve.

Many buyers we’ve worked with start by testing one seasoned tradeline to observe the impact before expanding their strategy. This allows them to see how their credit profile responds, without overcommitting. At Tradeline Score, we believe in transparency and education—so we guide clients through the pros and cons of each option, rather than pushing a one-size-fits-all approach.

Ultimately, understanding seasoned vs new tradelines comes down to knowing your long-term goals. The difference lies in longevity, reporting power, and price. If you’re preparing for a major financial step like a mortgage application, seasoned accounts are typically recommended. But if you’re stacking for affordability or just starting out, newer accounts may still serve a purpose when layered properly. We’re here to help you choose responsibly.

For a deeper understanding of how tradelines, including authorized user accounts, impact credit reporting and scoring, the Federal Reserve Board offers an insightful analysis. Their study discusses the role of authorized user accounts in credit scoring models and the implications of practices like “piggybacking.” This information can provide valuable context for those exploring the differences between seasoned and new tradelines. You can access the full report here: Credit Where None Is Due? Authorized User Account Status and “Piggybacking Credit”.

Seasoned vs New Tradelines – Why Tradeline Age Matters in Credit Strategy

The age of an authorized user tradeline can significantly influence your credit profile. Older (seasoned) accounts may enhance your average age of credit, a known scoring factor in models like FICO and VantageScore. Meanwhile, newer tradelines can still offer benefits like utilization reduction and active account reporting.

If you’re unsure which type of tradeline works best for your situation, we recommend reviewing our credit boost strategy guide and checking your tradeline eligibility first.

It’s important to align the tradeline age with your credit objectives. A seasoned tradeline can increase credibility, while a newer tradeline might be a more affordable way to create activity. Knowing how each affects your profile can save time and improve results.

In our experience, understanding the real difference between seasoned vs new tradelines often comes down to your financial goals. For instance, someone trying to enhance their credit profile ahead of a mortgage application may lean toward seasoned tradelines due to their longer history and credibility. On the other hand, newer tradelines are typically more affordable and can still contribute positively by lowering utilization rates and adding active accounts.

At Tradeline Score, we’ve seen many clients benefit from a blended approach. While seasoned tradelines can carry more perceived weight in a profile, newer ones may post faster or offer more flexible statement dates. In most cases, it’s less about choosing one over the other and more about understanding how each fits into your strategy. That’s why we encourage users to review current inventory with their specific needs in mind.

When comparing seasoned vs new tradelines, it’s also helpful to consider the timing and reporting cycle. For example, a newer tradeline with the right reporting schedule may help meet a short-term credit need, while a seasoned tradeline might serve better in long-term planning. Balancing both options strategically can create a more dynamic and adaptive credit-building plan.

If you’re exploring lower-cost new tradelines, browse our cheap tradelines for sale.

What Are Seasoned Tradelines?

Seasoned tradelines are accounts that have been open and in good standing for at least 24 months—often longer. These accounts demonstrate longevity, stability, and responsible credit behavior over time. Key features of seasoned tradelines include:

- 2+ years of age

- Perfect payment history

- Low utilization (under 10%)

- Active, open status

Seasoned tradelines are ideal for individuals looking to build age and trustworthiness in their credit profile. These are commonly used when applying for home loans, business credit, or when aiming to establish strong account history quickly.

Keep in mind, the more seasoned the tradeline, the more impactful it is on your credit age and perceived financial responsibility. That’s why they tend to come at a higher price but offer potentially greater results in score optimization.

When comparing seasoned vs new tradelines, one key difference is the credibility they signal to lenders. In most cases, a seasoned tradeline shows a proven track record of responsible use over time, which can carry more weight when applying for larger credit lines or business funding. New tradelines, while still valuable, may not offer the same depth of history but can be useful for boosting account variety or filling short-term reporting gaps.

We’ve seen clients take different paths depending on their goals. Some prefer to invest in just one high-quality seasoned tradeline, especially if they’re preparing for a major purchase. Others start with newer tradelines that fit their budget and gradually build up. At Tradeline Score, we typically recommend evaluating both options side by side to see which aligns best with your current credit strategy and timeline.

It’s also worth noting that newer tradelines tend to post faster and offer more flexibility in terms of price and slot availability. So, while seasoned tradelines offer more longevity and trust-building power, newer ones may be ideal in scenarios where quick reporting or affordability is a top priority. Like most things in credit, your needs dictate the right balance when deciding between seasoned vs new tradelines.

What Are New or Less Seasoned Tradelines?

New tradelines are typically under 24 months old but still active and in good standing. While they may not boost average age significantly, they can contribute in other ways:

- Improve revolving account count

- Reduce credit utilization if high-limit

- Trigger reporting activity to help wake up a thin or dormant file

These are more affordable and useful for individuals who simply need to add an open, positive tradeline to their file. New tradelines can also complement seasoned ones when stacking for broader credit impact, which is why comparing seasoned vs new tradelines is a smart place to start when evaluating your strategy.

For budget-conscious buyers, newer tradelines can be an excellent starting point to begin building a credit file or supplement a larger tradeline strategy. When used in tandem, seasoned vs new tradelines offer unique advantages depending on your timeline and goals.

In most cases, newer tradelines are a smart entry point for someone who’s just starting to build their credit profile. We’ve seen clients pair one or two new tradelines with consistent account activity and gradually work their way into qualifying for seasoned tradelines over time. When used together, this layered approach can often mimic the benefits of long-standing credit history without the upfront cost.

The reality is, the seasoned vs new tradelines decision doesn’t have to be either/or. At Tradeline Score, we typically recommend thinking of newer tradelines as a way to generate fresh reporting data, while seasoned tradelines provide the historical depth that lenders often look for. Our dashboard makes it easy to compare seasoned vs new tradelines side-by-side so you can match your credit goals to your current budget and timeline.

Some users we’ve worked with began with just one affordable new tradeline, waited for it to post successfully, then reinvested into a seasoned one after seeing how the process worked. Whether you’re stacking multiple accounts or testing the waters, understanding the purpose of seasoned vs new tradelines can help you make more confident, informed choices when building credit intelligently.

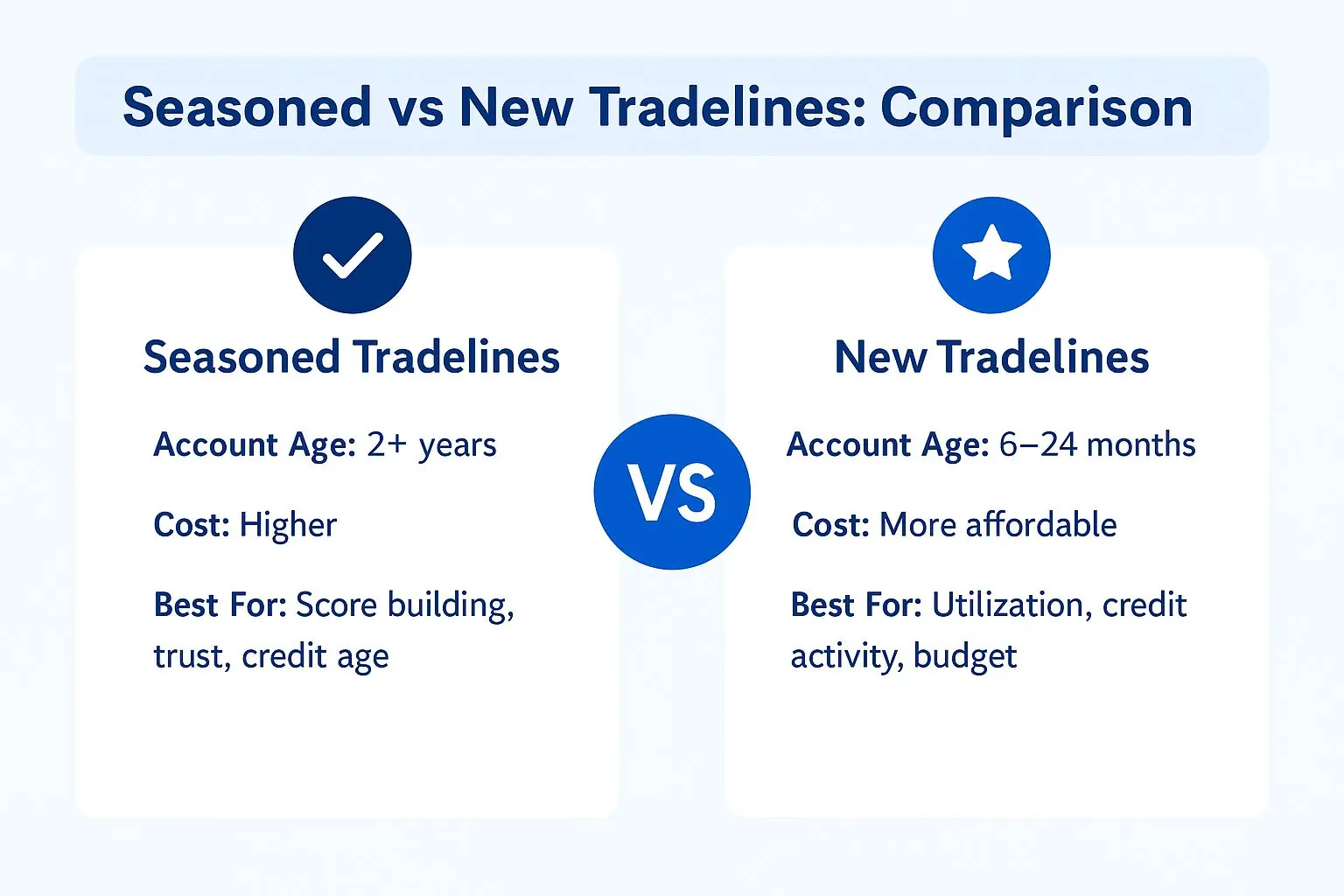

Seasoned vs New Tradelines – Quick Comparison

![]()

Seasoned Tradelines

- 2+ years of history

- Stable reporting activity

- Helps increase average account age

- Ideal for boosting credibility

![]()

New Tradelines

- Recently opened accounts

- Short or no payment history

- Useful for utilization padding

- Supports fast bureau coverage

Want to explore expert-curated bundles? Check out our

Tradeline Packages.

Which Type Should You Choose?

The right tradeline depends on your goals. Are you focused on average account age, utilization, or adding more activity to your credit report? Use the comparison below to help guide your decision.

| Feature | Seasoned Tradeline | New Tradeline |

|---|---|---|

| Account Age | 24+ months | 6–24 months |

| Cost | Higher | More affordable |

| Best For | Score building, trust, credit age | Utilization, credit activity, budget |

Still unsure? Learn how to buy AU tradelines safely or compare high vs. low limit tradelines to add clarity to your buying process.

When comparing seasoned vs new tradelines, there’s rarely a one-size-fits-all answer. In our experience, some clients prioritize a higher account age because they’re preparing for large credit moves like a mortgage or business funding. Others may be earlier in their journey and simply looking to add more activity or reduce utilization quickly — which is where newer tradelines can offer practical value. The distinction between seasoned vs new tradelines becomes clearer when mapped to specific goals like long-term planning versus short-term score boosts.

It’s also worth thinking about timing and budget. While seasoned tradelines generally carry a higher cost, they may have more reporting history and stability — ideal for boosting trust. On the other hand, new tradelines are often more accessible and can still support score-building goals, especially when paired with the right utilization rate and posting schedule. Whether you’re leaning toward new or seasoned, understanding the seasoned vs new tradelines dynamic helps in making smarter credit-building decisions.

At Tradeline Score, we typically recommend that users start with clarity around their short-term and long-term goals. If you’re leaning toward seasoned tradelines for trust-building or need to post fast with a newer account, our dashboard helps you sort by age, limit, and price — so you can compare options that actually match your situation.

For a detailed breakdown of tradelines—how they’re reported and why they impact your credit—check out “Credit Tradelines Explained” by NerdWallet”.

Frequently Asked Questions – Seasoned vs New Tradelines

What is the difference between seasoned and new tradelines?

Seasoned tradelines have a long-standing credit history and consistent reporting activity, while new tradelines are recently opened accounts with little to no payment history. For a deeper breakdown, see our Seasoned AU Tradelines Explained guide.

Why do seasoned tradelines have more credit impact?

Seasoned tradelines carry aged credit history, lower risk signals, and tend to show stability—making them more valuable for boosting average account age and credit scores. Learn more in our What Makes a Tradeline Seasoned article.

Are new tradelines ever worth using?

Yes. New tradelines can still be useful when you need quick bureau coverage or utilization padding. They’re often used to supplement a seasoned line. See our High‑Limit vs Low‑Limit Tradelines guide for strategy tips.

How many tradelines should I add for best results?

The right number depends on your goals and profile. Most users benefit from stacking 1–2 seasoned lines with strategic add-ons. Explore our How Many Tradelines Should I Buy? article for specific recommendations.

Can I buy seasoned tradelines in bundles?

Yes. Bundled tradeline packages often include a mix of seasoned and new lines to help balance age, limit, and reporting goals. Browse our curated Tradeline Packages for powerful combinations.

Start with the Right Tradeline for Your Credit Goals

Explore verified AU tradelines—both seasoned and new—on our secure platform. Compare listings by age, limit, bureau, and more. All listings come with escrow protection and verified posting.

Choosing between seasoned vs new tradelines ultimately comes down to your credit goals and timeline. Some users we’ve worked with needed to boost the average age of their accounts ahead of a big financial move—like applying for a business loan—and found seasoned tradelines to be the better fit. Others, especially those earlier in their credit journey, opted for newer tradelines to start building activity without stretching their budget. By understanding your specific needs, you can better evaluate the seasoned vs new tradelines decision in a way that aligns with your credit-building strategy.

Our platform is designed to make that decision easier. You can filter by age, utilization, statement date, and more—so whether you’re after a long-standing tradeline or a more affordable new option, the listings remain transparent and backed by verified posting. In most cases, people who take a few minutes to compare side-by-side end up feeling far more confident in their purchase. It’s another reason why comparing seasoned vs new tradelines directly within a verified marketplace can be so effective.

At Tradeline Score, we’ve seen that both seasoned vs new tradelines serve a valuable purpose—but context matters. Typically, seasoned tradelines are best for building trust and adding credibility, while newer ones may support faster activity reporting or better slot availability. We encourage you to explore the options with your unique situation in mind.