Tradeline Eligibility Criteria Explained

Know exactly what qualifies you to be added to an authorized user tradeline—and what to look for before selecting a listing.

Need to view available tradelines? Go back to Buy Tradelines for pricing, packages, and inventory. Explore more tradeline education and credit strategies on the Tradeline Score homepage.

Watch: Tradeline Eligibility Criteria – Who Can Qualify to Sell?

Understanding who qualifies to sell tradelines is essential to maintaining trust and compliance on Tradeline Score. In this video, we break down the specific tradeline eligibility criteria—from bank account requirements to payment history, account limits, and age. You’ll learn what makes an account eligible, how our approval process works, and what standards are in place to protect buyers. Whether you’re new or experienced, this video will help you confidently meet our tradeline quality standards.

At Tradeline Score, we’ve noticed that many first-time sellers are surprised by how simple the process can be once they meet the basic tradeline eligibility criteria. In most cases, if your credit card has been open for at least two years, carries a low balance, and has a perfect payment history, it may already qualify. We typically recommend checking your statement date and usage before listing, as these factors can affect your posting success.

Some of our top-performing sellers started with just one qualifying card and scaled gradually as they became more familiar with the platform. What worked best for them wasn’t just the account itself—it was their consistency. Meeting the initial tradeline eligibility criteria is only the beginning; maintaining on-time removals, monitoring usage, and responding to support requests all play a role in long-term success. Sellers who revisit the eligibility criteria for tradelines as they grow tend to avoid common mistakes and scale more effectively.

We believe the best sellers are those who treat the process with care and transparency. That’s why our platform was designed to make it easy to verify whether your cards are eligible—and why our team is always available to review your account if you’re not quite sure. If you’re ever uncertain about a detail, just ask. In most cases, we can walk you through tradeline eligibility criteria in under five minutes.

Understanding how authorized user accounts impact credit is an important part of meeting tradeline eligibility criteria. According to research from the Consumer Financial Protection Bureau (CFPB), nearly 1 in 10 consumers begin building credit through authorized user tradelines—often as their first step into credit visibility. This insight highlights how properly structured and eligible tradelines can play a strategic role in helping individuals strengthen or establish a credit profile.

Why Eligibility Criteria Matter

When it comes to buying AU tradelines, not every person or profile is a good fit. That’s why understanding eligibility criteria is critical to selecting a tradeline that has the best chance of reporting and providing the desired result. These criteria apply both to buyers and the tradelines themselves.

To avoid misaligned expectations and ensure better reporting success, it’s important to consider your personal credit file, your reporting history, and the rules of each issuing bank. We also recommend reviewing our AU tradeline safety guide if this is your first time.

Without meeting the correct qualifications, tradeline purchases may result in non-posting, delays, or refunds. Having clarity on eligibility helps protect your investment and enhances success across all tradeline packages.

In most cases, understanding the tradeline eligibility criteria ahead of time can help you avoid the most common pitfalls—like delays in reporting or incomplete postings. We’ve worked with many first-time buyers who assumed any tradeline would help their file, only to find out their credit report had outdated information or a fraud alert blocking the process. Taking a few minutes to review these eligibility requirements for tradelines upfront often makes all the difference.

At Tradeline Score, we’ve seen that buyers who get the best results are those who treat tradeline selection as part of a larger strategy—not just a transaction. That means confirming that their credit profile is active, checking for soft or hard blocks from the bureaus, and only choosing tradelines that match their goals. It may sound like a lot, but once you understand the basic tradeline eligibility criteria, navigating options becomes much easier and more efficient.

Our goal is to help users avoid mismatches and set realistic expectations from the start. Whether you’re buying a tradeline to prepare for a mortgage or just trying to strengthen your profile, tradeline eligibility criteria is where it all begins. We’re always here to help if you’re unsure whether your report or timeline fits a particular tradeline package.

Basic Requirements for Buyers

- Full legal name, residential address, and date of birth (DOB)

- US-based credit profile (international buyers not supported)

- Clean reporting history—no credit freezes or fraud alerts

- Must not have been removed from a card by the same issuer in the past 6 months

- Willingness to follow instructions and timelines provided after purchase

These criteria ensure that once you are added to a tradeline, it reports correctly to the credit bureaus. If your profile has unusual flags or inactivity, we suggest a timeline review before purchase.

Ineligible buyers may face reporting failures, delayed posting, or disqualification from future purchases. That’s why our team performs proactive screening and provides guidance to ensure you meet the criteria before any tradeline is assigned.

We’ve found that buyers who review the tradeline eligibility criteria in advance tend to experience smoother reporting and fewer delays. For example, even something as simple as an outdated address or a freeze on your credit file can block a tradeline from posting—even if the card itself is perfect. That’s why we encourage all buyers to double-check their profiles for common reporting flags before placing an order.

In most cases, buyers with clean, active credit files and no recent removals from the same issuer will qualify without issue. However, if you’ve been removed from a card within the last few months or have a dormant profile, our team may suggest a custom timeline or a different approach. These steps aren’t meant to exclude you—they’re designed to align with our internal tradeline eligibility criteria to protect your investment and increase the chances of success.

At Tradeline Score, we believe clarity around tradeline eligibility criteria helps buyers avoid wasted time and unnecessary risk. Whether you’re new to tradelines or returning for another round, we’re here to ensure every order meets the right eligibility benchmarks for tradelines—so it’s aligned with your goals and set up to post accurately and on time.

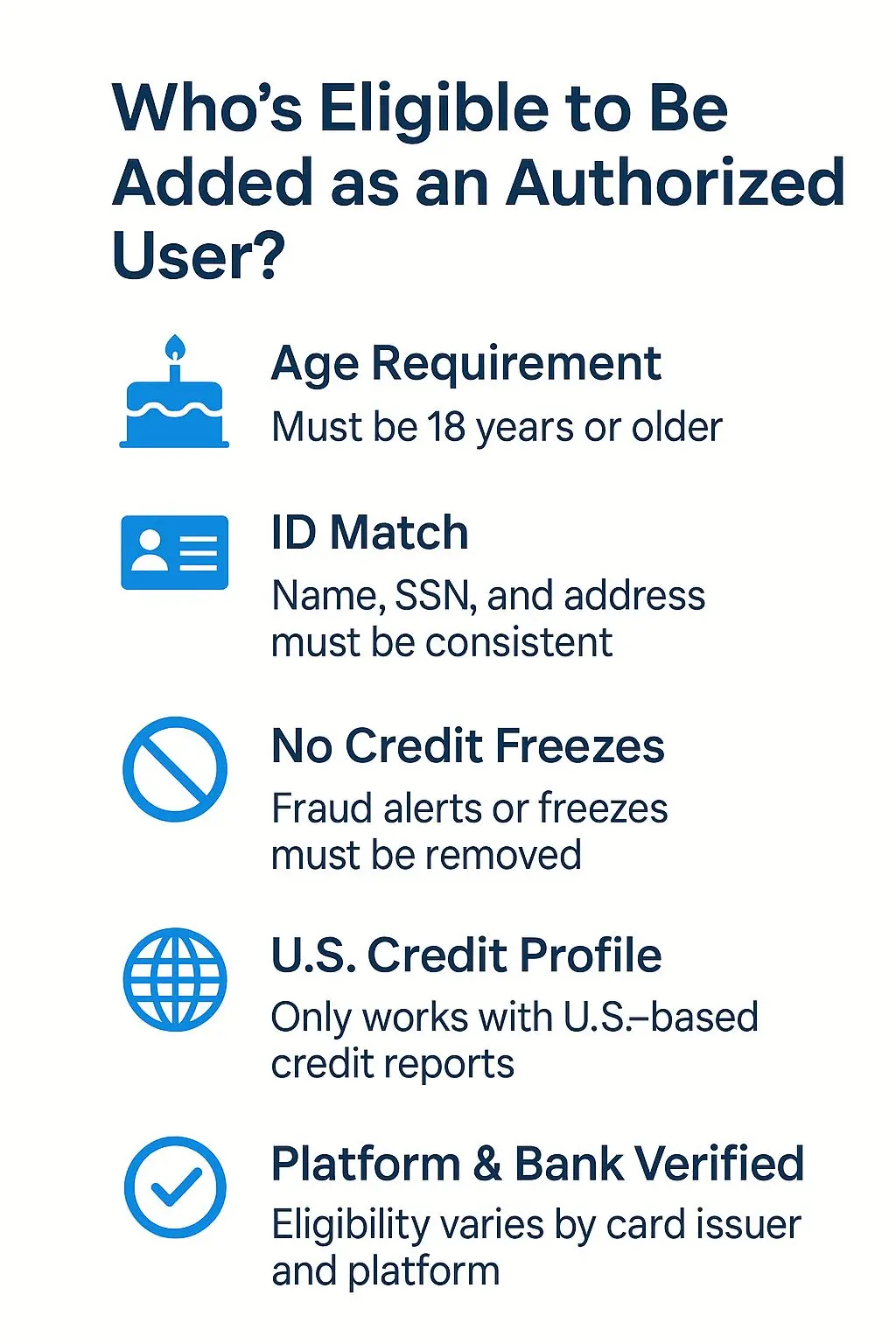

👥 Authorized User Tradeline Eligibility Criteria

Must Be 18 Years or Older

Most card issuers require authorized users to be at least 18 years old to be eligible.

Valid Government ID & SSN

Your name, address, and identity must match across all documentation and the credit bureaus.

No Active Fraud Alerts or Freezes

Credit freezes or fraud alerts must be removed before a tradeline can post successfully.

U.S.-Based Credit File

Tradelines can only post to U.S. credit reports. International profiles are not supported.

Matches Platform & Bank Requirements

Each tradeline platform and card issuer has their own specific eligibility rules — always review them before purchase.

What Makes a Tradeline Eligible

To be offered as part of our tradeline inventory, each AU tradeline must meet strict vetting standards:

- Minimum age of 24 months

- At least one major bureau must report (Experian, Equifax, or TransUnion)

- Utilization under 10%

- Perfect payment history (no lates or charge-offs)

- Open, active account in good standing

Listings that meet these criteria will be labeled accordingly. You can also compare seasoned vs. new tradelines and high-limit vs. low-limit options based on your individual goals.

Tradelines that fail to meet these qualifications are removed from our inventory immediately. Our priority is offering secure, escrow-backed listings that meet compliance and performance benchmarks for optimal posting success.

In our experience, the tradelines that perform best over time consistently meet all core tradeline eligibility criteria—not just on paper, but in real-world reporting outcomes. For example, many of our long-time sellers started with one card that met the 24-month age minimum, kept utilization under 5%, and followed a consistent posting history. These tradelines didn’t just meet criteria—they delivered proven results. Over time, they saw how keeping that card active, clean, and reliable led to steady AU activity and repeat earnings.

It’s also worth noting that not every “good” credit card qualifies under our strict tradeline eligibility criteria. In most cases, cards that haven’t reported in months, carry variable balances near the limit, or have ever shown late payments—even if corrected—tend to underperform in reporting. That’s why we’ve built in automated filters to remove anything that doesn’t align with our eligibility benchmarks, helping protect both buyers and sellers from inconsistent results.

At Tradeline Score, we believe in offering more than just inventory—we offer assurance. Our vetting system is designed to reward account holders who maintain quality over time. Meeting the tradeline eligibility criteria is the first step, but maintaining those standards is what creates long-term success in the tradeline space.

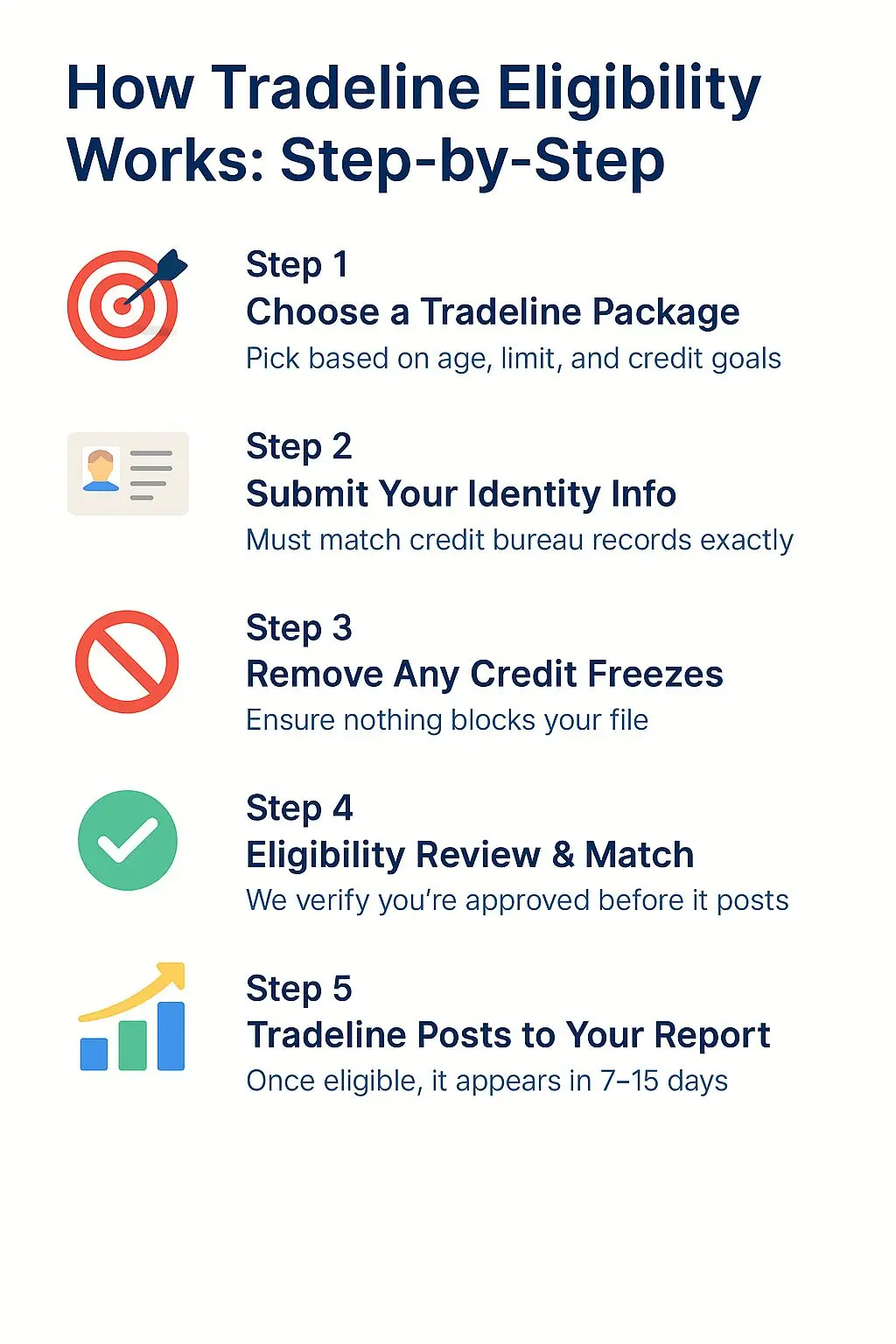

Maximizing Eligibility and Reporting Success

Even with strong tradeline credentials, posting success can be affected by buyer-side factors. Before purchasing, take time to:

- Temporarily lift any active credit freezes

- Ensure your address and personal info match exactly on your credit profile

- Purchase at least 5–7 days before the card’s statement date

- Choose AU tradelines with reporting dates that align with your goals

Understanding credit-boosting strategies can help you match the right tradeline to your current credit situation, ensuring compliance and long-term benefit.

Our customer support team is available to help screen your profile and suggest AU tradelines that offer the best fit based on your eligibility. Reach out before placing an order to avoid errors or wasted opportunities.

In our experience, many of the most common posting issues stem from small mismatches that are easy to fix—if caught early. For example, buyers who meet all tradeline eligibility criteria on paper might still run into problems if their credit profile has a fraud alert or their address doesn’t match what’s on file with the credit bureaus. These small details can prevent even the best tradeline from reporting correctly.

That’s why we generally recommend doing a quick credit profile review before selecting a tradeline. It doesn’t take long, and in most cases, it helps avoid refund requests, timeline delays, or buyer disqualification. We’ve also found that buyers who take this step upfront tend to have a better overall experience with the posting timeline and account performance.

At Tradeline Score, we’re committed to helping you succeed—not just sell you a listing. If you’re unsure whether you meet all the tradeline eligibility criteria, or you’ve had issues with reporting in the past, our support team can walk you through a short checklist before you complete your order. It’s one of the easiest ways to avoid setbacks and protect your investment.

❓ Frequently Asked Questions About Tradeline Eligibility

Who is eligible to be added as an authorized user on a tradeline?

Most people 18 years or older with a valid Social Security Number and a U.S.-based credit profile are eligible. However, compliance guidelines must be followed to ensure safe and legal posting.

Do I need a minimum credit score to qualify for tradelines?

No — tradelines are often used by individuals with low or no credit scores to help build or repair credit. Learn more about how to use tradelines to improve your credit profile.

Can someone with a credit freeze or fraud alert be added?

Generally no — credit freezes or fraud alerts may block the tradeline from posting. It’s important to remove freezes and ensure your profile is clear before purchase.

Does my name and address need to match exactly?

Yes, your full legal name and address must match what’s on file with the credit bureaus. Mismatches can cause posting failures or delays. Review our safe tradeline purchasing checklist for more tips.

Can I still be eligible if I’ve filed bankruptcy?

Yes — while results may vary, individuals with past bankruptcies can still benefit from tradelines. Focus on choosing the right tradeline package that fits your current goals.

For further insight into how authorized user accounts are reported—and why meeting each Tradeline Eligibility Criteria is crucial—check out this detailed guide by Experian:

🌐 Will Being an Authorized User Help My Credit? (Experian)

Check Your Eligibility and Buy with Confidence

Now that you understand tradeline eligibility, choose a verified listing that fits your goals. Review full profiles, statement schedules, and account limits before checkout. We’re here to help every step of the way.

Before you move forward with selecting a tradeline, it’s worth taking one last moment to double-check your profile against the basic tradeline eligibility criteria. In most cases, buyers who do a quick review—checking for things like outdated personal info or unresolved credit freezes—end up saving time and getting faster, smoother results.

We’ve seen plenty of successful users start with just one tradeline that matched their credit goals perfectly. Whether you’re trying to reduce utilization, add age to your profile, or simply start building, the key is choosing a listing that fits both your credit file and the platform’s posting requirements. Matching your goals with the right account begins with understanding the eligibility checklist.

At Tradeline Score, we’ve designed the buying experience to be transparent, supportive, and fully backed by real reporting data. If you’re unsure whether you meet the necessary tradeline eligibility criteria, don’t hesitate to reach out. Our support team is here to help you feel confident before checkout—because clarity today leads to better results tomorrow.