High-Limit vs. Low-Limit Tradelines

Explore how credit limits impact utilization, reporting value, tradeline stacking, and purchase strategies for better credit planning.

Visit our homepage to explore tradeline strategies. Want to browse available tradelines by limit?

Visit our Buy Tradelines page for real-time inventory and pricing.

High-Limit vs Low-Limit Tradelines: What Brokers Need to Know

Discover how high-limit and low-limit tradelines affect credit utilization, reporting strength, and your client strategy. This video breaks it down for brokers looking to deliver better results. Tradeline Score provides escrow-protected AU tradelines, giving you full control, real-time status updates, and the flexibility to match clients with the right limit. Build smarter, faster, and more confidently with the tools built for scale.

When evaluating high limit vs low limit tradelines, it’s helpful to start with your credit goals. In most cases, high-limit tradelines are preferred for clients looking to optimize utilization ratios or apply for larger lines of credit. That said, we’ve seen plenty of buyers reach their goals using a mix of moderate-limit accounts—especially when paired with strong age and consistent reporting history. Understanding how to navigate high limit vs low limit tradelines can give you a strategic edge based on your current financial profile.

Many sellers we’ve onboarded started by offering just one solid low-limit card and scaled from there. Over time, as they saw what buyers responded to, they adjusted their listings to include higher-limit options that moved faster. This trend aligns with what our internal data shows: in most scenarios, a high-limit tradeline offers more visible impact, but stacking low-limit accounts can still be an effective strategy for layered profile building. For sellers and buyers alike, learning the benefits of high limit vs low limit tradelines is essential when setting listing expectations and credit improvement goals.

At Tradeline Score, we believe there’s no one-size-fits-all approach. We recommend weighing factors like your current credit utilization, existing account mix, and future financing plans when deciding between high limit vs low limit tradelines. Our platform lets you filter by limit, age, and bureau so you can customize your strategy with confidence. If you’re still unsure which route is best, reviewing our guide on high limit vs low limit tradelines can help clarify the path forward.

For a deeper understanding of how credit limits can influence your credit report and overall utilization, it’s helpful to reference official guidance. According to the Consumer Financial Protection Bureau (CFPB), your credit utilization ratio—how much credit you’re using compared to your available limit—is one of the key factors in determining your credit score. Generally, lower utilization is seen more favorably by credit scoring models. To explore how this works, visit the CFPB’s official resource on how credit scores are determined.

How Credit Limits Influence Your Credit Report

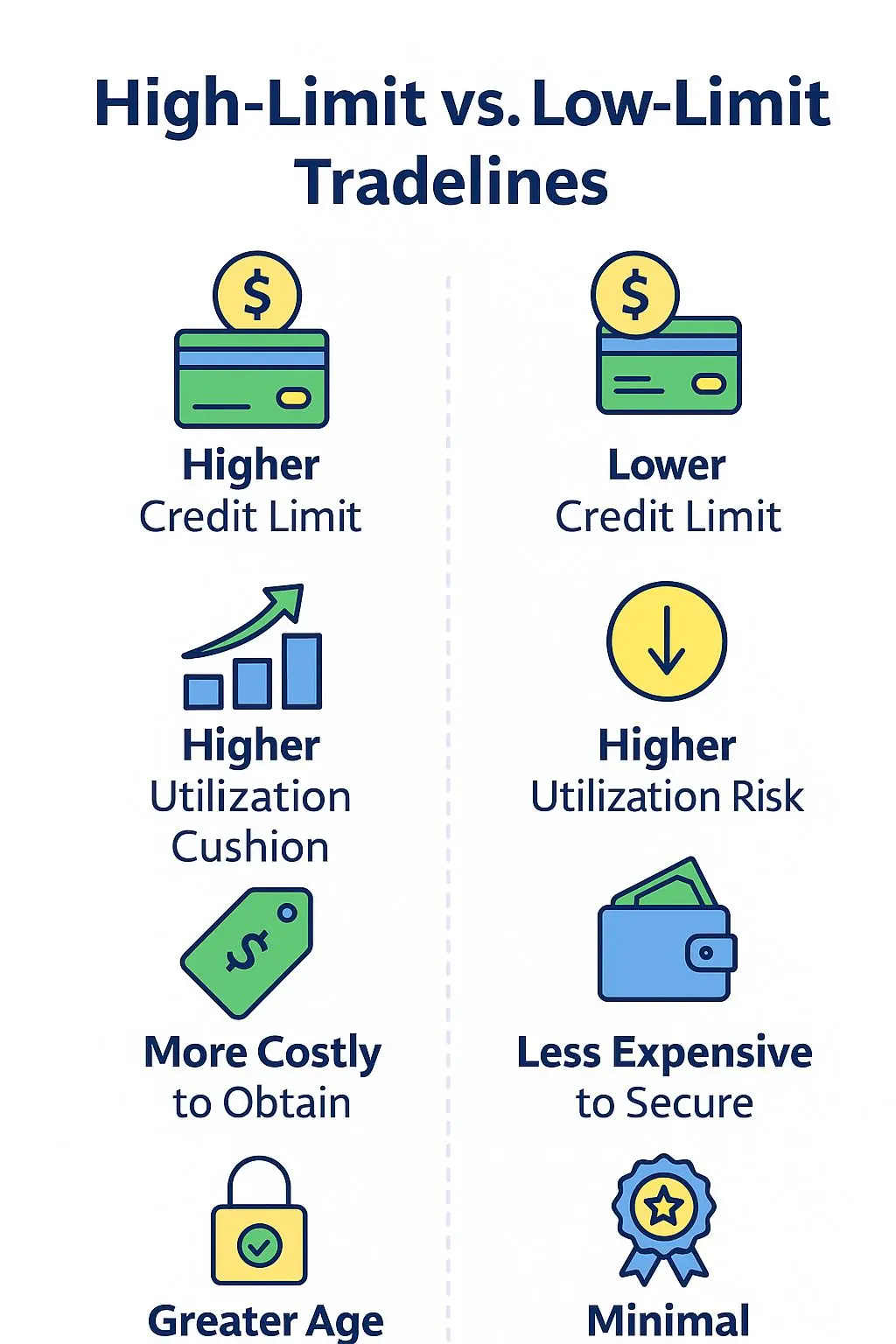

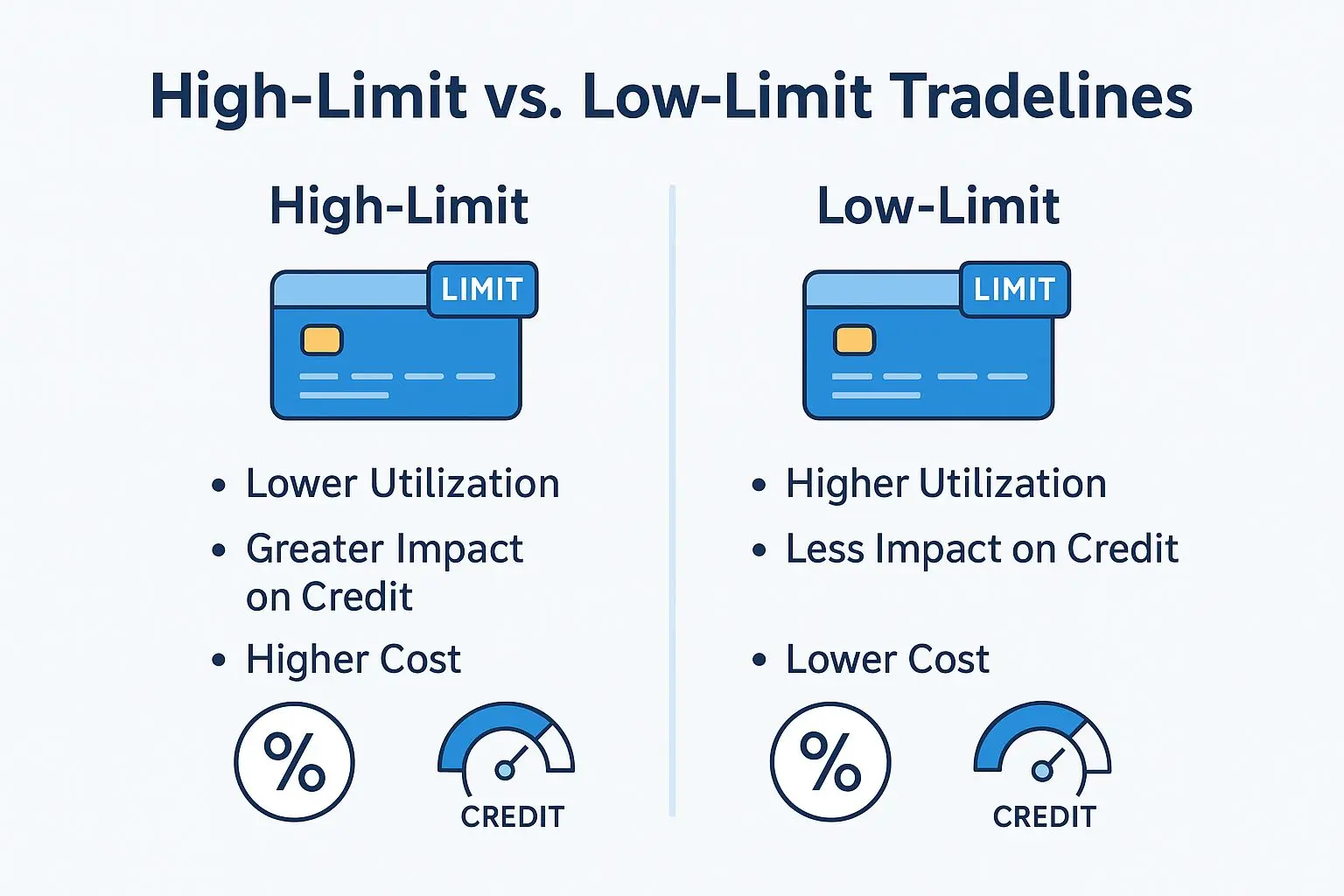

Credit limit is one of the most important factors in calculating credit utilization—a key component of your credit score. Tradelines with higher limits can significantly lower your utilization ratio, while lower-limit tradelines are still useful for profile depth, activity, and revolving credit diversification.

Whether you’re focused on minimizing utilization or simply adding positive account history, the tradeline limit you choose should align with your current credit profile and financial goals. Review our credit boost strategy guide to better align your selection.

Credit bureaus assess not only how much credit you use, but how much is available to you. Higher available credit often reflects lower risk, which makes high-limit tradelines a valuable tool for optimizing perceived creditworthiness—especially when combined with seasoned tradelines.

From what we’ve seen across thousands of transactions, the high limit vs low limit tradelines conversation usually depends on the user’s stage in their credit-building journey. First-time buyers might start with lower-limit tradelines simply to establish positive history, while seasoned users tend to prioritize high-limit options to reduce utilization and show stronger credit capacity. There’s no one right answer—it’s about alignment with your specific goals and understanding how high limit vs low limit tradelines affect your profile at different stages.

For example, one of our partners who regularly works with auto loan applicants noticed better lender feedback when stacking one high-limit tradeline alongside a few aged, low-limit accounts. That mix allowed their clients to show both depth and responsible usage. Our experience shows that in most cases, a thoughtful blend of limits—rather than choosing only high or low—produces the most consistent profile improvements. Knowing how to leverage high limit vs low limit tradelines in these combinations is key to long-term results.

At Tradeline Score, we recommend evaluating high limit vs low limit tradelines the same way a lender might: consider how the combination reflects risk, history, and capacity. Our dashboard makes it easy to compare these variables side-by-side so you can stack with strategy, not guesswork.

Benefits of High-Limit Tradelines – High Limit vs Low Limit Tradelines

High-limit AU tradelines typically offer greater impact on utilization and creditworthiness. These accounts reflect responsible credit management and signal to lenders that you’re capable of handling larger credit responsibilities. Key benefits include:

- Ideal for reducing credit utilization ratios

- Improve profile strength for mortgage and auto loan applications

- Offset existing debt or high balances

- Improve lender confidence for high-value approvals

These tradelines often serve as anchors in tradeline stacking strategies, delivering measurable improvements when combined with low-limit or seasoned lines.

When comparing high limit vs low limit tradelines, it’s important to consider how your current credit profile looks to lenders. For example, many of the brokers we work with have found that stacking a high-limit tradeline alongside a couple of aged, low-limit lines often delivers stronger, more balanced reporting results. This combination not only improves utilization but also helps present a profile that reflects both stability and capacity.

In most cases, high-limit tradelines are used as anchors to reduce total utilization. But they aren’t always the right fit on their own. Someone rebuilding their profile after years of inactivity might benefit more from a mix that includes lower limits with longer histories. It all comes down to matching tradeline limits to your broader goals—whether that’s mortgage readiness, credit diversity, or simply improving your lender optics.

At Tradeline Score, we believe the smartest approach is usually a custom one. That’s why we’ve built our system to let you filter, compare, and combine tradelines by limit, age, and bureau coverage. We’ve seen time and again that the best results don’t come from choosing one over the other—but from strategically using high limit vs low limit tradelines together based on what the buyer is trying to accomplish.

High‑Limit vs. Low‑Limit Tradelines

🔝 High-Limit Tradelines

- Available credit typically $10,000+

- Stronger impact on credit utilization

- Preferred for major lending decisions

- Higher upfront cost

- Useful for credit strength signaling

📉 Low-Limit Tradelines

- Available credit under $5,000

- Moderate help with utilization padding

- Ideal for affordability or add-ons

- Lower cost of entry

- Often paired in custom bundles

When Low-Limit Tradelines Make Sense

Low-limit tradelines, while offering less influence on utilization, are still valuable additions to many profiles. They increase the number of positive revolving accounts and improve the appearance of consistent credit activity. These tradelines are:

- Budget-friendly for first-time buyers

- Effective for building credibility on thin or new profiles

- Easy to layer with other tradelines for enhanced reporting

- Useful in cases where just one more active line is needed

They’re ideal for clients seeking affordability, simplicity, or minimal changes to their credit mix. Often, credit repair agencies and consultants use low-limit tradelines to fill reporting gaps before applying high-impact tools.

While it’s easy to gravitate toward high-limit cards, our experience shows that low-limit tradelines can quietly play a strategic role—especially for first-time buyers or those with thinner credit files. In fact, many sellers we’ve onboarded started with modest card limits and still saw reliable buyer matches because their lines offered consistency and age. When evaluating high limit vs low limit tradelines, it’s worth remembering that bigger doesn’t always mean better—it depends on the reporting goals.

Low-limit tradelines are typically budget-friendly and versatile. We’ve seen consultants pair them with aged, higher-limit lines to fill out reporting gaps or provide balance in a stacked profile. For example, one broker reported success using a $2,000 line to complete a credit profile that was missing just one more revolving account. That small addition helped the client pass manual underwriting.

At Tradeline Score, we believe the real value comes from strategy—not just the size of the limit. Whether you’re stacking lines or building from scratch, knowing when to use high limit vs low limit tradelines can be the difference between a good result and a great one.

Choosing the Right Credit Limit for Your Goals

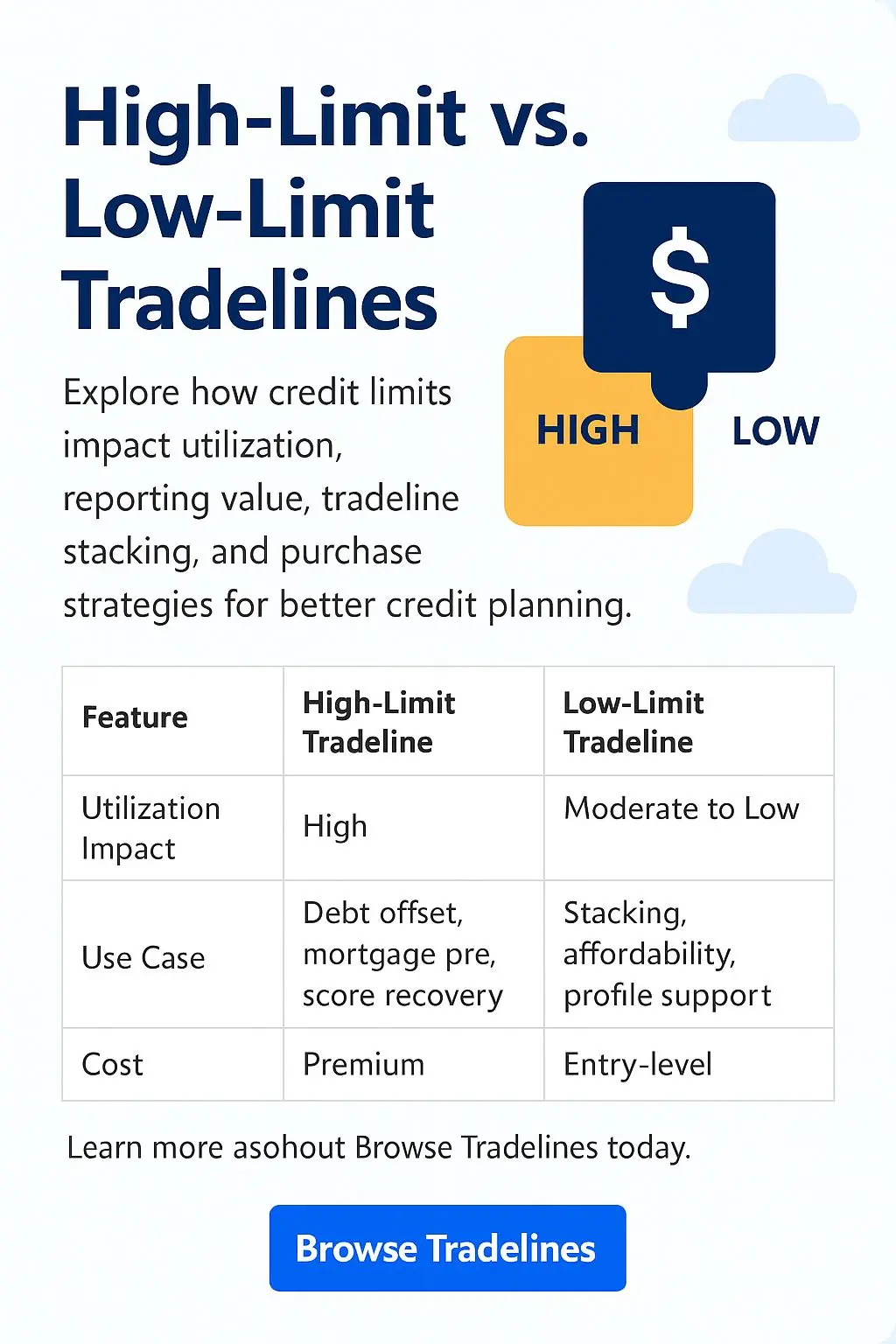

The ideal tradeline limit depends on your goals, budget, and the current health of your credit profile. Use the comparison table below to help guide your selection:

| Feature | High-Limit Tradeline | Low-Limit Tradeline |

|---|---|---|

| Utilization Impact | High | Moderate to Low |

| Use Case | Debt offset, mortgage prep, score recovery | Stacking, affordability, profile support |

| Cost | Premium | Entry-level |

Learn more about how long tradelines stay on your credit report to time your purchase properly and ensure it reports during key financial events.

When deciding between high limit vs low limit tradelines, your goals really dictate the best fit. In our experience, clients preparing for major financial milestones—like applying for a mortgage or recovering from high credit utilization—tend to benefit more from high-limit tradelines due to their strong impact on credit ratios. On the flip side, newer users or those stacking lines for profile depth usually start with low-limit tradelines to keep costs down while still boosting visibility.

We’ve seen many first-time buyers get results by layering two or three low-limit lines over time before graduating to higher-limit tradelines. It’s a common path for those working with tighter budgets or building credit in stages. Our partner dashboard even allows users to filter by limit so they can plan their stacking strategy more intentionally.

At Tradeline Score, we believe that credit-building should be both strategic and accessible. Whether you’re leaning toward premium lines or building incrementally, understanding the role of high limit vs low limit tradelines can help you match your tradeline investment with your current credit goals.

Managing your credit utilization is essential when comparing high-limit vs. low-limit tradelines. A higher limit can provide more flexibility and help maintain a lower utilization rate, which is a key factor in your credit score. According to Experian, keeping your credit utilization below 30% is generally recommended to support a healthy credit profile.

Frequently Asked Questions – High‑Limit vs. Low‑Limit Tradelines

What is the main difference between high-limit and low-limit tradelines?

High-limit tradelines are credit lines with large available credit—typically over $10,000—while low-limit tradelines have smaller credit limits. High-limit tradelines often carry more influence on credit utilization and perceived creditworthiness.

Do high-limit tradelines offer more credit benefit than low-limit ones?

Yes, high-limit tradelines can significantly reduce your utilization ratio, making them ideal for individuals seeking to optimize their credit profile. For more strategies, check out our Tradeline Credit Boost Strategies guide.

When should I choose a low-limit tradeline instead?

Low-limit tradelines are useful for padding utilization or diversifying your credit mix affordably. They’re often used in custom tradeline combos to balance age and limit within budget.

Does credit limit affect how long a tradeline stays on my report?

No, the credit limit doesn’t impact the duration of reporting. For more details on tradeline lifespan, visit our page on how long tradelines stay on report.

Are high-limit tradelines worth the higher cost?

In many cases, yes. High-limit tradelines tend to provide greater value, especially if your goal is to influence credit utilization or impress lenders. However, the best choice depends on your current credit profile and goals.

Find the Right Limit for Your Tradeline Strategy

Explore high and low-limit AU tradelines today. Use our secure dashboard to filter listings by limit, age, bureau, and reporting schedule. Every listing is backed by escrow and a guaranteed posting policy for your protection.

When comparing high limit vs low limit tradelines, it’s not about which is “better” overall—it’s about which is better for you. In most cases, high-limit tradelines tend to be more impactful for lowering utilization ratios and signaling creditworthiness to lenders. But that doesn’t mean low-limit lines aren’t valuable. Many buyers we’ve worked with start out by stacking a few modest tradelines to establish a strong foundation before moving into premium options.

Our experience shows that combining different tradeline types often leads to better long-term results. Some users pair a high-limit card with one or two smaller lines to balance cost and coverage. Others—especially brokers managing multiple clients—use low-limit tradelines to customize solutions for different credit profiles. The key is flexibility, and that’s what our dashboard is designed to deliver.

At Tradeline Score, we believe no two strategies should look exactly the same. Whether you’re rebuilding after a financial reset or prepping for a big application, understanding how high limit vs low limit tradelines play together gives you the insight to build smarter, not harder.