How Many Tradelines Should I Buy?

Finding the right number of AU tradelines for optimal credit profile impact.

Return to the Homepage or view our Buy Tradelines inventory.

Watch: How Many Tradelines Should I Buy? A Smart Strategy for Your Goals

If you’re asking how many tradelines you should buy, this video breaks down the answer based on your credit goals. Whether you’re rebuilding, optimizing for funding, or helping clients, Tradeline Score walks you through the impact of multiple authorized user (AU) tradelines—based on age, limit, and reporting history. Learn how combining one high-limit tradeline with a second aged tradeline can boost trust with lenders. Watch now to build a custom strategy that fits your timeline and budget.

Deciding how many tradelines to buy isn’t a one-size-fits-all answer. It really comes down to your current credit profile, your goals, and the timeline you’re working with. For example, many users we’ve worked with start with just one to two seasoned tradelines and see meaningful changes, while others—especially those rebuilding or applying for major financing—opt for a more layered approach with three or more. If you’re wondering how many tradelines should I buy, it’s helpful to first assess where your credit currently stands and where you want it to go.

In most cases, the right number of tradelines is a balance between quality and quantity. Our experience shows that stacking high-limit, low-utilization accounts with varied ages can create a more well-rounded profile than simply adding as many lines as possible. That’s why at Tradeline Score, we emphasize smart matching—not just volume. We’ve seen brokers and consultants manage 5+ AU slots per client effectively by tailoring the mix to match the buyer’s credit history and goals.

Ultimately, asking how many tradelines should I buy is a strategic question. Whether you’re building from scratch or recovering from a score drop, we recommend starting with 1–2 well-aged tradelines, then scaling based on how lenders respond to your profile. You can always consult our team for a custom recommendation, backed by real-time bureau reporting data and escrow-protected inventory.

Understanding how many tradelines you should buy starts with knowing how credit reporting works—and much of that is governed by federal regulation. For reliable information on consumer credit rights, tradeline visibility, and data accuracy, the Federal Trade Commission (FTC) offers a helpful overview of credit reports and how they’re used. To stay informed and make educated tradeline decisions, we recommend visiting the FTC’s official page on Credit Reports and Scores. This government resource can help you better understand how tradelines interact with your credit file under current U.S. law.

One of the most common questions we receive from clients is: how many tradelines should I buy? The answer depends on your current credit profile, goals, and how tradelines fit into your overall credit improvement strategy. This guide will help you assess the right number based on your credit report condition and enhancement timeline.

There is no one-size-fits-all answer, but we’ve worked with thousands of clients using seasoned vs. new tradelines to improve approval odds for everything from auto loans to business lines of credit.

For many clients, especially those just starting out or rebuilding credit, the question “how many tradelines should I buy” often comes down to quality over quantity. While adding more tradelines can increase your account diversity, it doesn’t always translate to better results. In our experience, starting with two to three strategically selected lines—blending age, limit, and bureau reporting—can offer more targeted value than loading up on accounts with minimal variation.

We’ve seen seasoned brokers and consultants recommend different numbers depending on the goal. For instance, one seller we work with started out using just a single AU tradeline to test reporting speed. Within two months, they expanded to managing 5+ accounts for clients needing layered strategies before major credit events. If you’re asking yourself how many tradelines should I buy, it’s smart to weigh your timeline, utilization ratio, and credit age before deciding.

At Tradeline Score, we generally recommend a custom approach. For some profiles, one high-limit line may be enough to improve optics; for others, stacking 2–4 tradelines across different bureaus can build a more complete foundation. The right answer varies, but our team can help you choose a lineup tailored to your goals—with verified data, clear expectations, and escrow-backed protection.

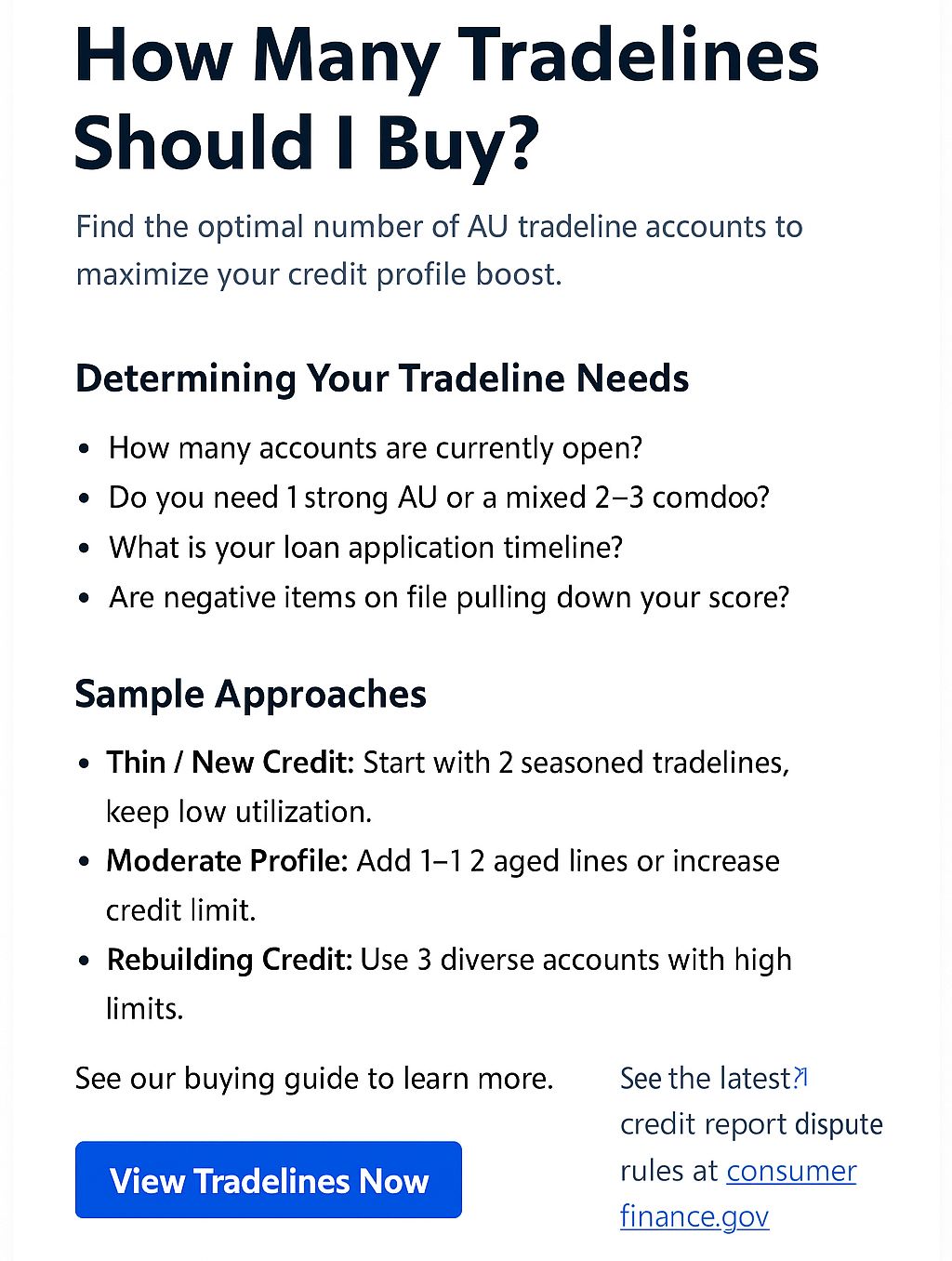

What Factors Determine How Many Tradelines You Need?

- Existing Credit Accounts: Do you have 1–2 or 5+ open accounts?

- Average Age of Credit: Are your current tradelines under 2 years old?

- Credit Goals: Are you applying for a mortgage, auto loan, or business funding?

- Negative Items: Do you need tradelines to counterbalance past late payments or collections?

Most clients see results with 1 to 3 seasoned tradelines that are well-matched in age and limit to their credit goals.

It’s also important to review eligibility criteria before selecting the number of AU tradelines to buy, ensuring you qualify based on report structure, address stability, and identity verification standards.

When clients ask us how many tradelines should I buy, we always begin by reviewing their existing credit landscape. A first-time buyer with only one active account may see notable improvements from just a single, well-aged tradeline. Meanwhile, someone with several open lines and a mix of derogatory marks might benefit more from a layered approach using 2–3 tradelines with varied age and bureau coverage. It’s rarely about quantity—it’s about strategic alignment with your report.

In most cases, our experience shows that 1 to 3 tradelines provide the right balance between cost and impact. Many sellers we’ve onboarded over the years began with just one qualifying line, then expanded their offerings based on client needs. For example, a credit repair agency we work with typically recommends starting with a high-limit tradeline and then stacking with a low-limit card to round out utilization and bureau distribution.

At Tradeline Score, we believe personalized planning always wins over guesswork. Whether you’re applying for a mortgage, cleaning up a report, or prepping for business funding, the question how many tradelines should I buy deserves a thoughtful, data-backed answer. That’s why we offer consultations and verified metrics to help ensure every purchase supports your credit timeline effectively.

Sample Tradeline Combinations by Profile – How Many Tradelines Should I Buy

Thin File / New Credit: Start with 2 tradelines, each over 3 years old and reporting under 10% utilization. (How Many Tradelines Should I Buy)

Moderate Credit / Low Age: Add 1–2 tradelines to boost your average age and reduce overall utilization. (How Many Tradelines Should I Buy)

Damaged Credit / Rebuilding: Choose 3 tradelines with high limits, strong age, and excellent payment history to offset negative items. (How Many Tradelines Should I Buy)

Need help choosing? View our tradeline package guide.

Use our credit boost strategies page for ideas on how to layer AU tradelines with other tools like credit builder loans or secured cards.

If you’re still wondering how many tradelines should I buy based on your credit situation, real-world examples can help simplify the decision. In most cases, we’ve seen that clients with thin files or brand-new credit profiles start seeing movement with just two tradelines—especially when they’re over 3 years old and report low utilization. It’s not about loading up with lines; it’s about choosing ones that add age, depth, and bureau coverage to your report.

For those with moderate or low average credit age, adding just one or two tradelines can often balance your overall utilization while helping your credit profile look more seasoned. In our experience, brokers and credit consultants frequently recommend stacking a high-limit tradeline with one lower-limit line to keep things affordable yet impactful.

When it comes to rebuilding or working around negative items, the question how many tradelines should I buy typically shifts toward quality and structure. We usually recommend 3 tradelines in this case—strong age, high limits, and consistent posting history. At Tradeline Score, we believe effective planning can outperform volume. Strategic combinations always beat a scattershot approach.

Tips for Choosing the Right Number

- Match tradelines with varied statement dates to stagger reporting

- Ensure reporting to all three bureaus for full coverage

- Avoid over-stacking (more than 4 tradelines) unless for credit repair layering

- Use tradelines in conjunction with credit boosting strategies

Overloading your report with too many new AU accounts can look artificial. Instead, focus on quality over quantity. One strong tradeline may outperform three weak ones.

Our team reviews each order and provides suggestions when possible. Be sure to review our FTC/FCRA guidelines page to understand our compliance-first model.

The question of how many tradelines should I buy isn’t about quantity alone—it’s about strategy. In our experience, a few well-placed tradelines that vary in limit, age, and reporting bureau often outperform a larger set of randomly selected ones. Many of our clients have seen success by stacking 2–3 tradelines with different statement dates and bureau coverage to maximize visibility across the reporting cycle.

It’s typically a good idea to avoid overloading your credit profile, especially if you’re working with newer AU accounts. Adding 5 or more tradelines at once can sometimes raise red flags with lenders, depending on your file. Our team generally recommends focusing on layering—using tradelines strategically to support specific credit goals rather than just adding more lines.

At Tradeline Score, we review each order with a compliance-first lens and, when needed, provide guidance on which types of tradelines fit your situation. Whether you’re purchasing your first tradeline or managing a bulk strategy, asking how many tradelines should I buy should always start with a clear understanding of your timeline, credit mix, and intended use.

Ready to Buy the Right Tradelines?

Whether you’re starting with your first tradeline or building a portfolio for credit repair, our team is here to help. All listings are verified, escrow-backed, and compliant with FTC/FCRA rules.

If you’re still wondering how many tradelines should I buy, you’re not alone—it’s one of the most common questions we hear. In most cases, your tradeline count should reflect your credit goals and timeline. Some users see noticeable improvements with just one well-aged, high-limit tradeline, while others—especially those managing multiple credit events—may benefit from a layered combo of two to three.

Our experience shows that the ideal number of tradelines varies based on your starting profile. For example, many sellers we’ve onboarded started with just one qualifying card, then scaled to 5+ AU slots monthly as they gained confidence and results. At Tradeline Score, we believe credit-building should be purposeful—not just transactional.

That’s why we take a tailored approach to every account. Whether you’re trying to offset recent negatives, boost age and utilization, or simply build a stronger-looking profile, answering how many tradelines should I buy starts with the right support. And that’s exactly what we’re here to provide.