Tradeline Prices Compared – 10 Real Examples That Save You More

These 10 side-by-side comparisons show why brokers and buyers choose Tradeline Score. Bigger limits, seasoned history, and lower prices with escrow protection.

💡 Watch: Transparent Tradeline Pricing Brokers Can Trust

Looking for the best tradeline prices without sacrificing compliance or transparency? This short video highlights real examples of how Tradeline Score consistently delivers better value with escrow protection, verified sellers, and lower pricing across the board. Whether you’re buying in bulk or sourcing for clients, knowing exactly what you’re paying for—without hidden fees—can make all the difference.

| Example | Other Platforms | Tradeline Score | Savings |

|---|---|---|---|

| 10-Year History | $10,000 Limit | $950 | $620 | $330 |

| 6-Year History | $8,000 Limit | $730 | $480 | $250 |

| 7-Year History | $21,000 Limit | $900+ | $682.50 | $220+ |

| 9-Year History | $10,000 Limit | $850 | $292.50 | $557.50 |

| Seasoned + Low Utilization | $850+ | $545 | $305+ |

| Bundle (3 Lines) | 20+ Years | $2,400 | $1,380 | $1,020 |

| High Limit | $34,000+ Aged 20 Years | $1,100+ | $780 | $320+ |

| Low Limit | 6 Months Age | $150+ | $97.50 | $52.50 |

| Old Age | $5,000 Limit | $650+ | $385 | $265+ |

| Ultra-Seasoned Bundle (5 Tradelines) | $3,800+ | $2,290 | $1,510+ |

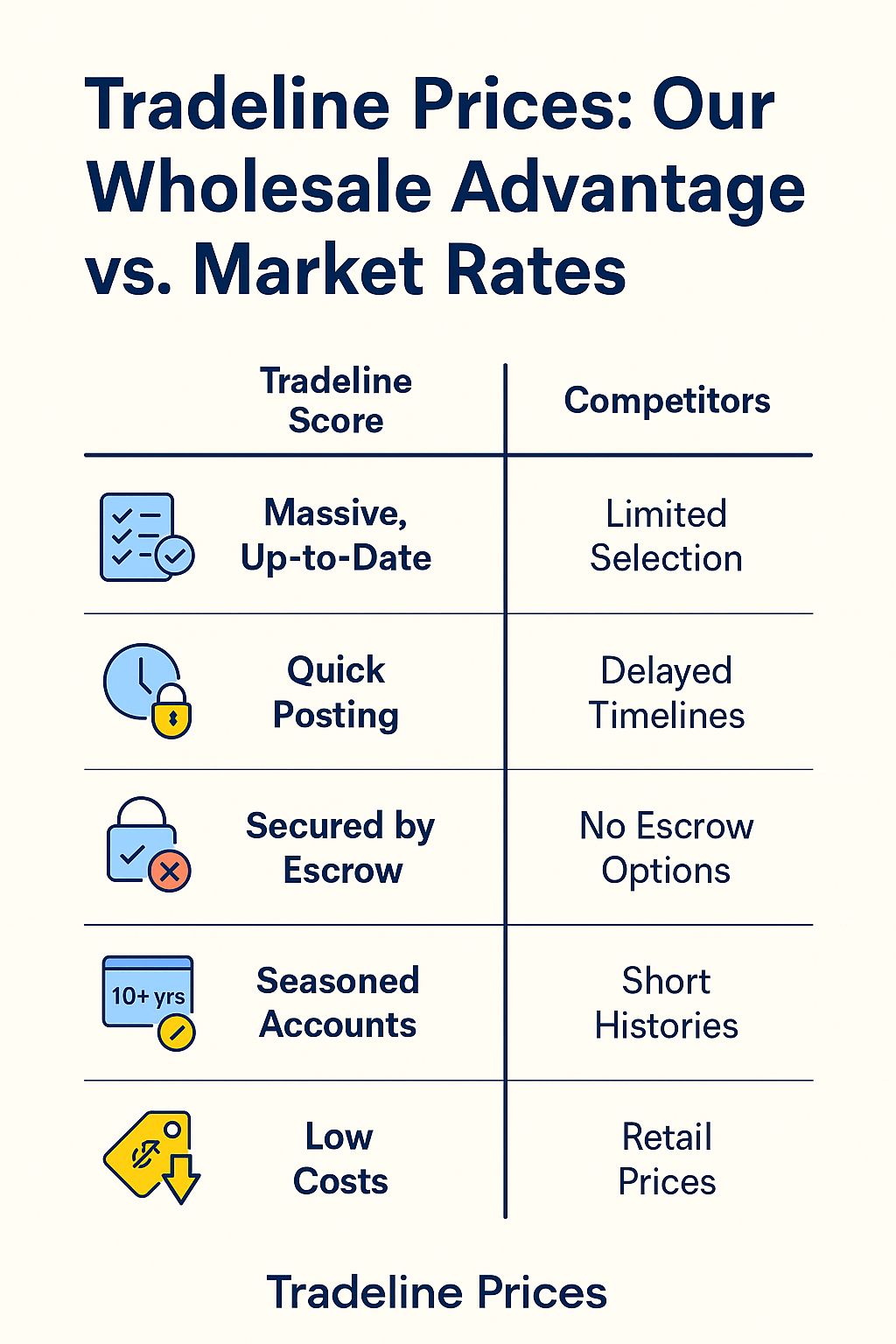

Why Our Pricing Beats the Competition

- Escrow Protection: You never pay unless the tradeline posts. Learn how it works.

- No Retail Markups: Our pricing saves 30–40% vs. most platforms.

- Massive Inventory: Filter tradelines by age, limit, issuer, and reporting bureau.

- Credit Card Payments: Easily pay for tradelines using major credit cards through our secure, escrow-backed system—no complicated wires or delays.

When brokers compare tradeline prices across platforms, one major differentiator is escrow protection. At Tradeline Score, we ensure that no payment is released until the tradeline posts successfully. This gives brokers and clients peace of mind when investing in authorized user tradelines. For a closer look at how escrow secures every purchase, visit our escrow-protected tradeline transactions page.

Most competitors add hidden fees or retail markups that inflate tradeline prices, leaving brokers with lower margins. Tradeline Score removes those retail layers by offering true wholesale pricing — helping brokers save 30–40% on average. With better tradeline pricing, brokers can scale profitably and offer more competitive rates to clients without compromising quality.

One reason our tradeline prices consistently outperform others is our massive, curated inventory. You can filter by age, limit, reporting bureau, and more, all while knowing that every listing is FTC-compliant. Instead of navigating vague or inflated pricing structures, you can rely on transparent, broker-first pricing designed for scale and compliance.

For additional clarity on how authorized-user tradelines influence credit scores and legal compliance requirements, the Federal Reserve’s in-depth study on “Credit Where None Is Due?” offers valuable insights.

It explains how Regulation B under the Equal Credit Opportunity Act requires reporting of authorized-user accounts—and highlights the benefits of aged account history when used correctly. Brokers seeking transparency and regulatory alignment with AU tradelines will find this resource especially helpful: Federal Reserve paper on authorized-user tradelines.

What Impacts the Cost of an AU Tradeline?

The cost of an authorized user (AU) tradeline depends on several core factors: the age of the account, the credit limit, the utilization rate, and the issuing bank. Older accounts with high limits and low utilization typically command a premium. At Tradeline Score, we provide complete transparency—each listing shows exactly what you’re paying for and which bureaus are covered.

Unlike other platforms, we never mark up prices without merit. Every listing is verified for accuracy and price competitiveness, ensuring you’re paying for real value—not just marketing fluff.

AU tradeline prices are influenced by several key variables, including the account’s age, credit limit, and utilization rate. Tradelines with 10+ years of history and low utilization typically command higher pricing due to their perceived credibility and positive reporting impact. At Tradeline Score, we carefully label these features on every listing so brokers can understand how these elements affect overall tradeline pricing.

While other platforms often inflate tradeline prices with markups or vague premiums, we provide full transparency. Each listing clearly states the credit bureau coverage, posting timeline, and key account details that impact pricing. If you’re unsure how these elements affect outcomes, our guide on tradeline eligibility criteria breaks down what brokers should consider before purchasing.

Understanding tradeline prices also means understanding value—not just cost. Our platform never marks up prices without cause. Every tradeline is backed by compliance and verified account data. Brokers can browse listings knowing they’re getting competitively priced options tailored to their clients’ needs without the fluff or exaggerated benefits often found elsewhere.

Why Broker Markups Cost You More Than You Think

Many providers inflate tradeline pricing with unnecessary markups. These broker markups can quietly eat into your margins, especially when buying in volume. Some platforms charge over $900 for a tradeline you could get at Tradeline Score for nearly half the price.

That’s why we offer direct broker access—no middlemen, no hidden fees. Whether you’re managing a few clients or a full agency, working with a wholesale partner helps you scale smarter and save more.

Tradeline prices often appear inflated because of unnecessary broker markups. Many platforms add hidden fees or retail-level margins that drastically reduce your profit per client. When you’re paying $900+ for a tradeline, it’s not because the account is better—it’s because of markup. At Tradeline Score, we offer true wholesale tradeline pricing, so brokers can maximize ROI without cutting corners.

Understanding how tradeline prices are structured is critical when scaling your business. Hidden markups can quietly erode margins, especially if you’re purchasing multiple accounts per month. That’s why we provide direct broker access—giving you transparent, commission-free pricing that lets you focus on growth without overpaying.

The best tradeline prices come from working directly with a platform that serves brokers, not middlemen. At Tradeline Score, our model is built for agencies and high-volume buyers who need fast onboarding, bulk pricing, and real account-level data. No markups. No fluff. Just verified listings and support that scales with your business needs.

How to Choose the Right Tradeline Prices for Your Client’s Goals

Not every tradeline suits every credit goal. A younger profile might benefit from high-limit lines, while a thin file may require age and payment consistency. At Tradeline Score, we’ve built in search filters that help you identify exactly what your client needs, whether it’s seasoned tradelines or lines with strong reporting activity.

Our customer support team is also on standby to help you match listings with your client’s timeline and financial target—because the right tradeline is the one that fits your strategy, not just your budget.

Choosing the right tradeline prices starts with understanding your client’s unique credit needs. A newer profile may benefit more from a high-limit tradeline to boost utilization, while a thin file with no credit history might require a long-standing account with consistent reporting. Tradeline Score’s platform allows you to filter by age, limit, and bureau so that each tradeline aligns with the client’s credit-building objective—not just price.

While it’s tempting to choose the cheapest tradeline, smart brokers focus on the overall credit impact. That’s why we offer an entire page on how to buy AU tradelines safely, helping brokers match the right tradeline prices with the appropriate credit goals. Safety, age, and reporting patterns all play a role in long-term success.

The right tradeline prices aren’t just about discounts—they’re about strategic selection. Our team is available to help you pinpoint which lines make sense based on your client’s timeline, target score range, and reporting needs. Tradeline Score simplifies the process by combining powerful filters, expert support, and real-time inventory, so you always match strategy with pricing.

5 Fast Examples – Compare at a Glance

| Tradeline Type | Tradeline Score |

|---|---|

| 10-Year | $10,000 Limit | $620 |

| 6-Year | $8,000 Limit | $480 |

| 20-Year Bundle (3 Lines) | $1,380 |

| Low Limit | 6 Months Age | $97.50 |

| Seasoned + Low Utilization | $545 |

Ready to lock in better tradeline prices? Get instant access to wholesale rates and verified listings.

These 5 examples make it clear—our tradeline prices outperform the competition. Whether you’re evaluating a 20-year bundle or a simple $8,000 line, you’ll see immediate savings without sacrificing reporting quality. For brokers buying in bulk, our wholesale tradelines page offers even more value with tiered pricing models and bulk-friendly tools.

By putting tradeline prices front and center, we make it easy for brokers to compare options based on age, credit limit, and utilization—all in one glance. It’s not just about what you pay, it’s about the long-term benefits your client receives through seasoned, escrow-protected tradelines that actually report.

Ready to Save Big on Every Tradeline?

Tradeline Score empowers brokers to scale smarter with the lowest prices, escrow-backed protection, and an unbeatable range of verified listings. Learn how to become a broker here.

If you’re comparing tradeline prices across platforms, you’ll quickly notice the difference Tradeline Score offers. We deliver the lowest broker rates in the industry, backed by escrow protection and verified account history. Whether you’re buying one tradeline or building a portfolio, our competitive pricing helps you scale without sacrificing margin.

Smart brokers rely on transparent tradeline prices to maximize profit and client satisfaction. At Tradeline Score, every listing is clearly priced, filtered by age, limit, utilization, and bureau. Visit our custom tradeline combos page to explore how bundling can boost value while saving you even more.

Escrow-protected listings, unbeatable tradeline prices, and a broker-first experience—that’s the Tradeline Score difference. We’re here to help you succeed with tools that prioritize trust, compliance, and scalability. It’s not just about cost—it’s about confidence in every purchase you make.