How Tradeline Posting Works: Timelines & What to Expect

Understand what happens after you buy a tradeline—including posting timelines, reporting windows, and how to verify your results.

Return to the Buy Tradelines page or view our Posting Guarantee Policy.

In most cases, tradelines begin posting within a few business days after the cardholder adds the authorized user, but this timeline can vary depending on the card’s statement date and bureau reporting cycles. From what we’ve seen at Tradeline Score, sellers who maintain strong communication and use long-standing accounts with consistent history typically see smoother, more reliable postings.

Understanding how tradeline posting works isn’t just about waiting for a score change—it’s about tracking reporting activity to the right bureau at the right time. Many of our affiliates and buyers use third-party credit monitoring tools to verify updates and document the posting window. This is why we include statement dates and estimated timelines on each listing—to help set clear expectations upfront.

At Tradeline Score, we believe transparency and education go hand in hand. Knowing how tradeline posting works helps buyers avoid confusion and focus on measurable outcomes. Whether you’re buying your first tradeline or managing multiple clients, having a realistic timeline in mind is key to making strategic, compliant decisions.

When exploring how tradeline posting works, it’s essential to understand the broader context of credit reporting. The Consumer Financial Protection Bureau (CFPB) emphasizes the importance of accuracy in credit reports, noting that inaccuracies can significantly impact consumers’ financial well-being. Their research highlights that a substantial number of consumers have errors on their credit reports, which can affect credit scores and access to credit. For more detailed information, you can refer to the CFPB’s report on credit report disputes.

What Does Tradeline Posting Mean?

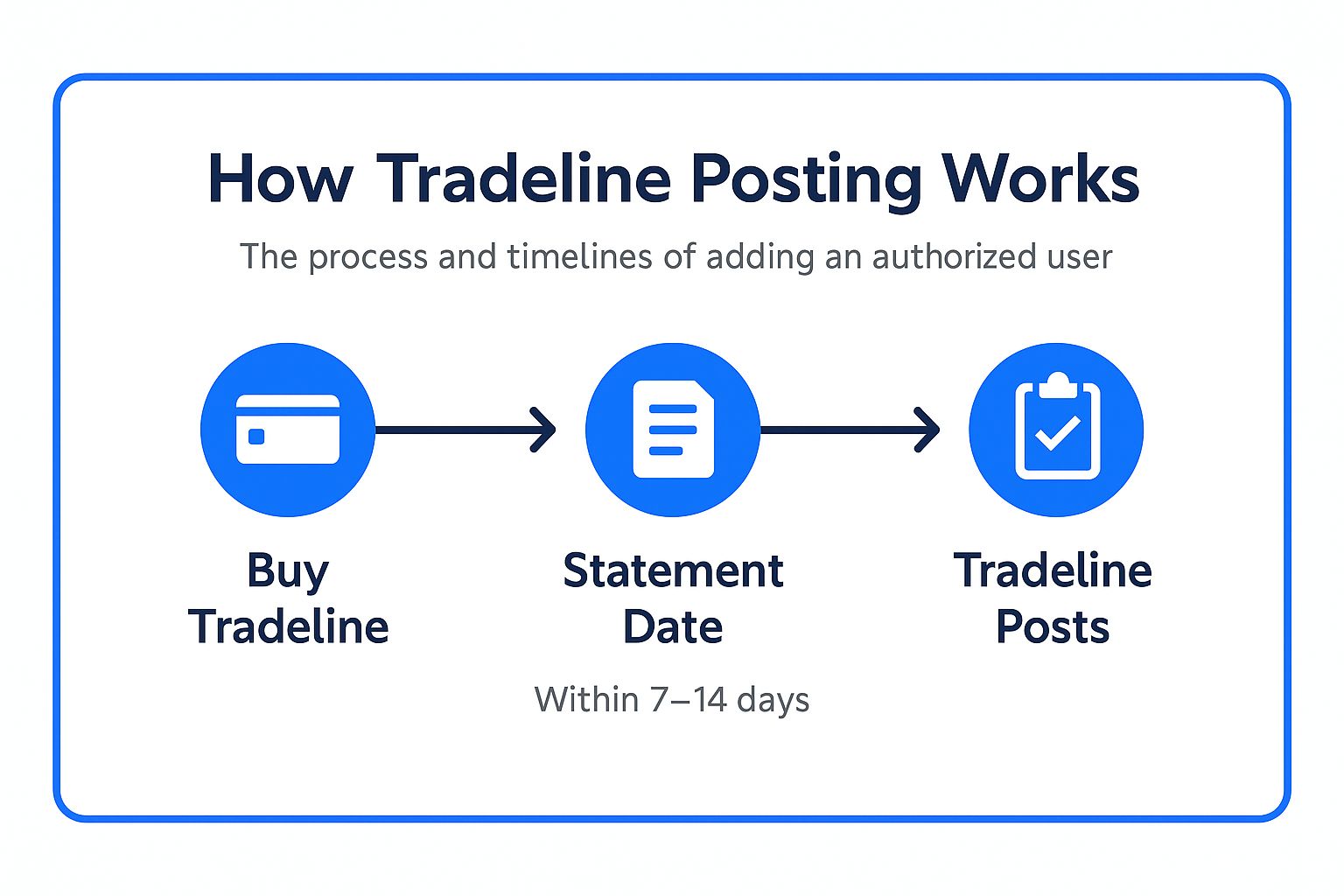

When you buy a tradeline through our platform, you’re being added as an authorized user (AU) to an existing credit card account. “Posting” refers to when that account appears on your credit report. This typically happens after the card issuer submits their monthly update to the credit bureaus.

In most cases, this means you’ll see the tradeline post within 7–14 days from the statement date. That said, timelines can vary slightly depending on the bank, bureau, and the accuracy of the personal information provided at checkout.

Many sellers we’ve onboarded started with just one qualifying card and now manage 5+ AU slots monthly—all because they understood how tradeline posting works from the beginning. In our experience, consistency is key. Sellers who use cards with predictable statement dates and stable histories tend to see fewer posting issues and higher buyer satisfaction.

Knowing how tradeline posting works also helps buyers manage expectations. For instance, if you purchase a tradeline close to a statement cut-off, it may not post until the following cycle. This doesn’t mean something went wrong—it’s just part of how credit bureaus receive and process updates from financial institutions. We’ve found that providing clear posting windows and realistic timelines helps eliminate confusion and builds trust on both sides of the transaction.

At Tradeline Score, we believe responsible sellers and informed buyers are the backbone of our marketplace. That’s why every listing includes estimated posting timelines and bureau coverage. When both parties understand how tradeline posting works, it reduces risk, improves outcomes, and contributes to a healthier credit-building process overall.

Tradeline Posting Timelines by Bureau

- Experian: Typically reports AU data within 7–10 days post-statement.

- TransUnion: Often the fastest—posts within 3–7 days for most users.

- Equifax: May take slightly longer and can be inconsistent. Plan for 10–15 days in most cases.

Each tradeline listing on our site includes estimated bureau posting coverage so you know what to expect before purchasing. For more on this, check out our guide on Which Credit Bureaus Report AU Tradelines.

Understanding how tradeline posting works by bureau can make all the difference when you’re planning around key application deadlines. We’ve seen cases where buyers were targeting mortgage preapprovals and selected tradelines that post quickest with Experian or TransUnion based on lender preferences. These types of timing decisions can have real-world consequences—especially when approval windows are tight.

In our experience, posting timelines are usually consistent, but there are always variables to consider. Some banks batch their reporting while others push updates more frequently. It’s why we always recommend verifying your personal details at checkout and reviewing the estimated timeline for each tradeline listing before making a purchase. Knowing what to expect helps avoid unnecessary stress and sets you up for success.

At Tradeline Score, our goal is to eliminate the guesswork. That’s why each tradeline includes projected posting ranges and bureau visibility. Whether you’re aiming for a short-term score boost or managing a client’s tradeline schedule, clarity around how tradeline posting works is a huge advantage. We’re here to help you navigate it with confidence.

How to Confirm Tradeline Posting

We recommend using a daily credit monitoring tool such as IdentityIQ, SmartCredit, or myFICO. Once the tradeline posts, it should appear on your report as an “Authorized User” account, showing the account’s age, limit, and balance.

If you’re working with a lender or planning a major application, be sure to download and save a copy of the report after the tradeline appears. If a tradeline doesn’t post by the expected timeframe, you may be eligible for reassignment or refund under our Posting Guarantee.

At Tradeline Score, we often get questions from buyers asking what to look for once the tradeline is supposed to post. Based on our experience, how tradeline posting works isn’t always intuitive the first time around—especially when it comes to timing across bureaus and tools. Most of our long-term sellers suggest clients monitor all three bureaus using platforms like IdentityIQ or SmartCredit for at least 10–15 days after the estimated statement date.

If you’re working with a lender or preparing for a high-stakes application, confirming that your AU tradeline has posted correctly can be the difference between a smooth process and unexpected delays. In most cases, the tradeline will appear under your report as an “Authorized User” account, clearly listing the credit limit and age. That’s your signal that everything went through as planned.

Should there ever be a delay, we offer posting support to walk you through next steps. We’ve even had users report successful resolutions just by updating their address formatting or verifying DOB spelling. That’s part of understanding how tradeline posting works—and why we stand behind every listing with support and a posting guarantee.

Frequently Asked Questions About Posting

What if my tradeline doesn’t show up?

Double-check that your name, address, and date of birth were entered correctly. If everything is accurate and the posting window has passed, contact our support team.

Do tradelines post to all three bureaus?

Not always. Some cards report to just one or two. Every listing on our platform shows expected bureau coverage so you can plan accordingly.

How long do tradelines stay on my credit?

Typically 30 to 60 days. After that, you’re removed from the account and the tradeline drops off during the next cycle. See our page on How Long Do Tradelines Stay on Report for more info.

At Tradeline Score, we’ve seen firsthand that most questions around tradeline delays come down to simple issues like name mismatches or a missing apartment number in the billing address. That’s why understanding how tradeline posting works isn’t just about timelines—it’s about attention to detail. Many of our top sellers advise clients to use the exact same spelling and formatting across all fields when submitting checkout information.

In most cases, tradelines post to credit reports within the expected window, but it’s helpful to remember that reporting isn’t always uniform across bureaus. Some cards may hit TransUnion early but take longer with Equifax. Our platform shows bureau coverage upfront so you’re never left guessing where your tradeline will land.

If your tradeline doesn’t show up on time, don’t panic. Our team is here to walk you through the process and ensure your purchase gets the results you expected. We built our escrow-backed system specifically to protect buyers and sellers in situations like these—because knowing how tradeline posting works should feel clear, predictable, and fully supported.

How Tradeline Posting Works

In most cases, tradelines begin posting within 7 to 14 days after the statement date of the credit card. But how tradeline posting works can depend on a few variables—including the issuing bank, the credit bureau, and how closely your personal information matches. For example, our team has seen scenarios where TransUnion reflects updates within 3–5 days, while Equifax may take up to two weeks. That’s why we always recommend giving yourself a little buffer, especially if you’re preparing for a major financial event like a loan or mortgage.

At Tradeline Score, we’ve helped thousands of users navigate the posting process smoothly. Many of our verified sellers manage 5+ AU slots monthly and have developed reliable routines to ensure reporting is consistent. How tradeline posting works is rarely about speed alone—it’s about matching the right card to your goals, verifying your identity accurately, and tracking results using trusted credit monitoring tools like IdentityIQ or SmartCredit.

Understanding how tradeline posting works isn’t just about timelines—it’s also about transparency. We encourage all buyers to review the posting window listed before checkout and to refer to our Posting Guarantee Policy if delays occur. When sellers and buyers are both aligned on expectations, the posting process becomes predictable and stress-free.

For buyers new to this space, it’s helpful to remember that how tradeline posting works isn’t always black and white. While some cards post rapidly—especially from major issuers—others may take a little longer due to statement cutoffs or bureau-specific timing. In our experience, clients who understand this nuance tend to feel more in control of the process and are better prepared to plan around their tradeline investment.

One example we often share: a buyer preparing for a mortgage preapproval needed a tradeline to post to Experian within 10 days. Because she double-checked posting dates and matched her name exactly as it appears on her credit file, the line posted within the expected window—and helped her secure favorable terms. It’s stories like these that highlight why how tradeline posting works is about preparation as much as timing.

At Tradeline Score, we believe buyer education is just as important as seller compliance. That’s why we share clear posting estimates, platform protections, and support every step of the way. When you know what to expect from tradeline posting, it stops feeling like a risk—and starts working like a smart, strategic tool.

Conclusion: What to Expect from Tradeline Posting

How tradeline posting works may vary slightly, but when managed responsibly, it’s a smooth and straightforward process. At Tradeline Score, our escrow-backed system ensures you only pay once the tradeline posts as expected. If you’re ready to explore trusted AU tradelines, we invite you to browse our listings and start building your profile with confidence.

In most cases, once the statement date passes, the process of how tradeline posting works becomes fairly predictable—as long as both parties follow the right steps. We’ve seen buyers who plan around expected posting windows enjoy smooth results with minimal surprises. For example, one of our long-time sellers consistently updates 5+ AU slots monthly, and his cards post within just 4–6 days to TransUnion. These types of success stories are more common than you might think when the process is respected.

At Tradeline Score, we often remind users that how tradeline posting works is more than just hitting a date—it’s about coordination and accuracy. From choosing the right tradeline to matching your legal name exactly, these small details can make all the difference. That’s why our platform clearly outlines bureau timelines, and we only release funds after a posting is confirmed.

Ultimately, when buyers take the time to understand how tradeline posting works and align their expectations with real-world timelines, the entire experience becomes more transparent and reliable. We built Tradeline Score to make that clarity standard—not optional.